What Are the Best Forex Scalping Strategies?

What Are the Best Forex Scalping Strategies?

Forex scalping strategies are considered to be one of the most effective strategies for making quick profits in the forex market. Scalping is a trading style that involves taking small, frequent profits in quick succession.

-

- by ALLFOREXRATING.COM

- 27th June 2022 | Post Views: 1279

Forex scalping strategies are considered to be one of the most effective strategies for making quick profits in the forex market. Scalping is a trading style that involves taking small, frequent profits in quick succession.

So, if you're looking to make quick and profitable trades in the forex market, then a scalping strategy could be the right one for you. In this article, we'll take a look at some of the best forex scalping strategies and how you can use them to your advantage.

What Is Forex Scalping Strategy?

Forex Scalping is a trading strategy designed to buy or sell a currency pair that can be effective to make some quick profits. A forex scalper strategist looks to make a large number of trades, taking advantage of the small price movements which are common throughout the day. Though leverage with forex scalping can magnify gains but also magnify losses.

Is Scalping in Forex Profitable?

Scalping is profitable because it allows you to make a lot of small profits in a short amount of time. The key to making money with scalping is to take advantage of small price movements.

By buying and selling currency pairs rapidly, you can capture these small movements and make a profit. However, scalping is also risky. If you don't know what you're doing, then it is obvious that you can lose money. That's why it's important to learn how to scalp before you start trading.

Is Scalping a Good Strategy?

Scalping can be a good strategy for traders who are looking to take advantage of small price movements in the market. Moreover, Scalpers may also enjoy the challenge of trying to make a profit in a short period of time.

Then, is Scalping good for beginners?

As we know, Scalping is a great strategy for any traders who are looking to make quick, small profits in the market with sufficient expertise. So, it can be a great way to get started in trading. Because it is also applied by experienced traders who are looking for quick profits.

Best Forex Scalping Strategies

There are numerous Forex scalping strategies. Most forex scalping strategies use indicators to tell traders when to trade. So, you can use a combination of the strategies discussed below.

Basically, whatever strategy you decide to use, look for confluence, where you get at least two signs that you have found an opportunity to buy or sell.

By using at least two signs, you are more likely to get results. Finding confluence is very subjective and depends on what indicators you are using. Let me explain a few best Forex scalping strategies.

❖ Exponential Moving Average

It shows the underlying trend behind a forex pair by showcasing the average price over a period of time, instead of the current price and this strategy can be used in a bullish or bearish market.

When the current price is above the EMA, it can be seen as a signal to sell; when the price is below the EMA, it can be a signal to buy.

- In a bearish market, when the price reaches the lowest EMA, it is a sign to sell. The opposite is true in a bullish market. When the price meets the highest EMA, it can be a sign to buy.

❖ Volume & Price Action

Here, Volume is your signal and the Price Action is your confirmation.

- When volume is low, it is a sign that a trend is dying and reversing, or that it is taking a break before continuing.

Low volume is followed by high volume and then price action in the short term (and not necessarily in the long term), which makes it highly useful for forex scalpers.

❖ Stochastics And Trend line

Stochastics measure if something is overbought or underbought.

- If it is above 80, it is classed as oversold, and below 20, is underbought.

To implement this strategy, you need to have an uptrend or a downtrend. Otherwise. it will be hard to use this strategy in a ranging market.

It is a good strategy as you have two options. Trading on a trend is one and the overbought, underbought condition from the stochastics acts as the second.

❖ Bollinger Bands

Bollinger Bands measure the highest and lowest points and can be great for knowing when to avoid the market.

- When prices reach the upper band, go short and when prices reach the lower band, go long.

This strategy can also be used in a ranging environment as well as a volatile one, though it can be more difficult.

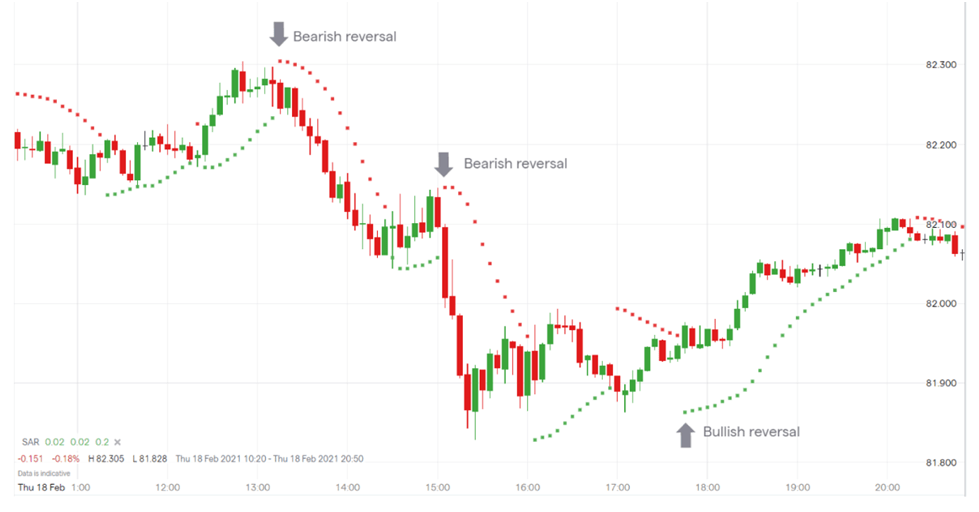

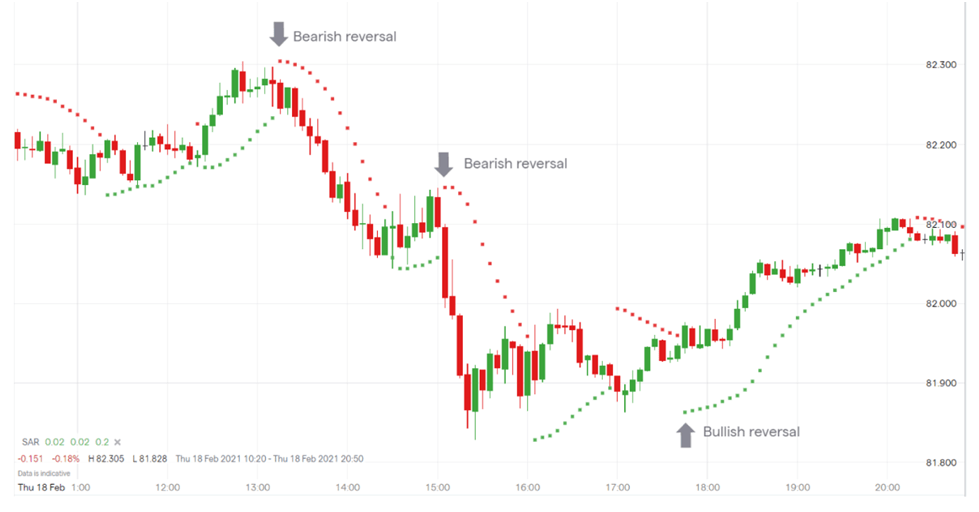

❖ Parabolic Stop And Reverse (SAR)

The parabolic SAR is a technical indicator that can be measured as dots above or below the market price. It helps traders to discover the best time to enter and exit a market.

- When green dots are below the current price, it can be signed as a buy signal, indicating a potential bullish market.

- On the other hand, when red dots are above the current price, it can be signed as a sell signal, indicating that a bearish market is imminent.

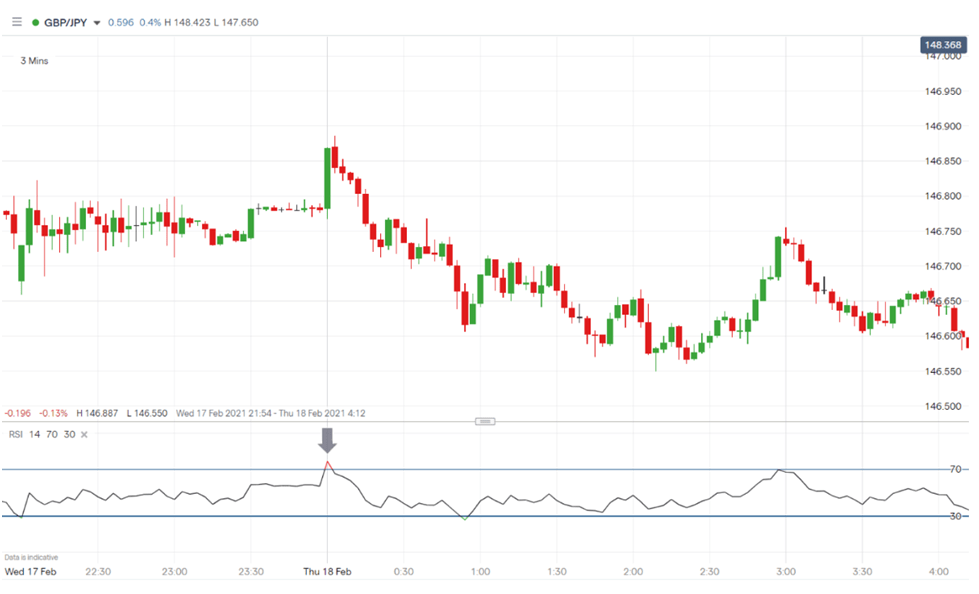

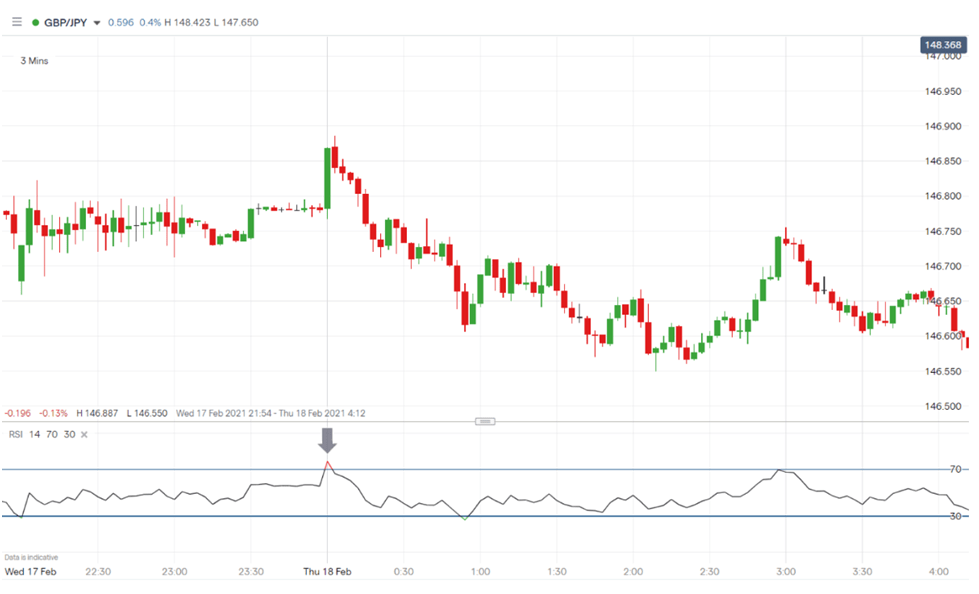

❖ Relative Strength Index (RSI)

RSI is a momentum indicator that uses a range of between zero and 100 to evaluate whether an underlying market’s current direction might be about to reverse. It uses levels of support and resistance to identify when the market’s trend might be about to change direction.

- When the RSI rises above 70, it might show that the market is overbought and a trader may benefit from opening a short position.

- If the RSI falls below 30, it might indicate that the market is oversold and a trader should open a long position.

Is Scalping Better Than Day Snd Swing trading?

Some traders may find scalping to be more profitable than day trading and likewise, the swing is better than scalping. Yeah, many FX traders prefer swing trading because it allows them to hold onto their positions for longer and potentially profit from bigger price movements. On the other hand, others may prefer scalping because it is a more active trading style that allows them to take advantage of small price movements.

In the meantime, others may find the opposite to be true. Ultimately, it is up to the individual trader, his/her skill, experience, and expertise to decide which style of trading is best or suitable for them.

Some More Related Short-Queries

How Do You Master Forex Scalping?

- There is no one-size-fits-all answer to this question. The best way to master forex scalping varies depending on the individual trader's goals, risk tolerance, and trading style. However, some tips on how to master forex scalping may include studying various scalping strategies, practicing with a demo account, and keeping a close eye on market conditions.

Which Time Frame Is Best for Scalping?

- Scalp trades can be executed in 1 minute, 3 minutes, 5 minutes, or even 15 minutes time frame. However, the choice depends on the trade and the asset involved. The 15 minutes time frame is not so common. Beginners generally trade around the 5 minutes time frame to strike the right advantage. But the advanced traders can go with 3 minutes trade precisely

Which Pair Is Best for Scalping?

- FX Traders should consider scalping major currency pairs such as the EUR/USD, GBP/USD, and AUD/USD, as well as minor currency pairs including the AUD/GBP.

How Many Pips Do You Use for Scalping?

- Scalpers like to try and scalp between 5 and 10 pips from each trade they make and repeat this process over and over throughout the day.

How Do You Become a Successful Scalper?

- Each scalper's success depends on his/her individual trading strategies. Whatever, some tips on becoming a successful scalper include staying disciplined, keeping a close eye on the markets, and always using stop-loss orders to protect your capital.

Which Forex Broker Is Best for Scalping?

- There is no definitive answer to this question as different traders have different preferences. Some forex brokers offer special accounts for scalpers, while others charge higher fees for this type of trading. Ultimately, it is up to the individual trader to decide which broker is best for

Why Do Some Brokers Not Allow Scalping?

- Many brokers do not allow scalping because they view it as a form of gambling. Scalping generally involves taking quick, small profits on a large number of trades, which can add up to a significant amount of money over time. Moreover, many brokers view this as an unfair advantage and do not allow it.

Is Forex Scalping Risky?

- While forex scalping can be profitable, it is considered a risky trading strategy.

How Do Scalpers Buy So Fast?

- The first, and most notorious, is called an AIO bot, or all-in-one bot. These move at an inhuman rate, scanning hundreds of websites every second to check if the PS5 is in stock.

The instant an item drops the bot will buy it and checkout, faster than a human could ever type their details.

What Are Scalping Bots?

- Scalping bots are computer programs that use artificial intelligence to identify and execute trades based on market conditions.

How Many Trades Do Scalpers Do in A Day?

- A scalper may make dozens or even hundreds of trades in a single day.

Conclusion

It is important to be clear-headed and try to keep things simple while implementing various forex scalping strategies. And, an FX trader must master one indicator first before moving on to combinations.

So, check that your strategies are working by either using a demo account to practice or using a significantly small amount to invest. And after that, try to find out your strategies for the foreign exchange.

Write a Comment

What Are the Best Forex Scalping Strategies?

Forex scalping strategies are considered to be one of the most effective strategies for making quick profits in the forex market. Scalping is a trading style that involves taking small, frequent profits in quick succession.

Forex scalping strategies are considered to be one of the most effective strategies for making quick profits in the forex market. Scalping is a trading style that involves taking small, frequent profits in quick succession.

So, if you're looking to make quick and profitable trades in the forex market, then a scalping strategy could be the right one for you. In this article, we'll take a look at some of the best forex scalping strategies and how you can use them to your advantage.

What Is Forex Scalping Strategy?

Forex Scalping is a trading strategy designed to buy or sell a currency pair that can be effective to make some quick profits. A forex scalper strategist looks to make a large number of trades, taking advantage of the small price movements which are common throughout the day. Though leverage with forex scalping can magnify gains but also magnify losses.

Is Scalping in Forex Profitable?

Scalping is profitable because it allows you to make a lot of small profits in a short amount of time. The key to making money with scalping is to take advantage of small price movements.

By buying and selling currency pairs rapidly, you can capture these small movements and make a profit. However, scalping is also risky. If you don't know what you're doing, then it is obvious that you can lose money. That's why it's important to learn how to scalp before you start trading.

Is Scalping a Good Strategy?

Scalping can be a good strategy for traders who are looking to take advantage of small price movements in the market. Moreover, Scalpers may also enjoy the challenge of trying to make a profit in a short period of time.

Then, is Scalping good for beginners?

As we know, Scalping is a great strategy for any traders who are looking to make quick, small profits in the market with sufficient expertise. So, it can be a great way to get started in trading. Because it is also applied by experienced traders who are looking for quick profits.

Best Forex Scalping Strategies

There are numerous Forex scalping strategies. Most forex scalping strategies use indicators to tell traders when to trade. So, you can use a combination of the strategies discussed below.

Basically, whatever strategy you decide to use, look for confluence, where you get at least two signs that you have found an opportunity to buy or sell.

By using at least two signs, you are more likely to get results. Finding confluence is very subjective and depends on what indicators you are using. Let me explain a few best Forex scalping strategies.

❖ Exponential Moving Average

It shows the underlying trend behind a forex pair by showcasing the average price over a period of time, instead of the current price and this strategy can be used in a bullish or bearish market.

When the current price is above the EMA, it can be seen as a signal to sell; when the price is below the EMA, it can be a signal to buy.

- In a bearish market, when the price reaches the lowest EMA, it is a sign to sell. The opposite is true in a bullish market. When the price meets the highest EMA, it can be a sign to buy.

❖ Volume & Price Action

Here, Volume is your signal and the Price Action is your confirmation.

- When volume is low, it is a sign that a trend is dying and reversing, or that it is taking a break before continuing.

Low volume is followed by high volume and then price action in the short term (and not necessarily in the long term), which makes it highly useful for forex scalpers.

❖ Stochastics And Trend line

Stochastics measure if something is overbought or underbought.

- If it is above 80, it is classed as oversold, and below 20, is underbought.

To implement this strategy, you need to have an uptrend or a downtrend. Otherwise. it will be hard to use this strategy in a ranging market.

It is a good strategy as you have two options. Trading on a trend is one and the overbought, underbought condition from the stochastics acts as the second.

❖ Bollinger Bands

Bollinger Bands measure the highest and lowest points and can be great for knowing when to avoid the market.

- When prices reach the upper band, go short and when prices reach the lower band, go long.

This strategy can also be used in a ranging environment as well as a volatile one, though it can be more difficult.

❖ Parabolic Stop And Reverse (SAR)

The parabolic SAR is a technical indicator that can be measured as dots above or below the market price. It helps traders to discover the best time to enter and exit a market.

- When green dots are below the current price, it can be signed as a buy signal, indicating a potential bullish market.

- On the other hand, when red dots are above the current price, it can be signed as a sell signal, indicating that a bearish market is imminent.

❖ Relative Strength Index (RSI)

RSI is a momentum indicator that uses a range of between zero and 100 to evaluate whether an underlying market’s current direction might be about to reverse. It uses levels of support and resistance to identify when the market’s trend might be about to change direction.

- When the RSI rises above 70, it might show that the market is overbought and a trader may benefit from opening a short position.

- If the RSI falls below 30, it might indicate that the market is oversold and a trader should open a long position.

Is Scalping Better Than Day Snd Swing trading?

Some traders may find scalping to be more profitable than day trading and likewise, the swing is better than scalping. Yeah, many FX traders prefer swing trading because it allows them to hold onto their positions for longer and potentially profit from bigger price movements. On the other hand, others may prefer scalping because it is a more active trading style that allows them to take advantage of small price movements.

In the meantime, others may find the opposite to be true. Ultimately, it is up to the individual trader, his/her skill, experience, and expertise to decide which style of trading is best or suitable for them.

Some More Related Short-Queries

How Do You Master Forex Scalping?

- There is no one-size-fits-all answer to this question. The best way to master forex scalping varies depending on the individual trader's goals, risk tolerance, and trading style. However, some tips on how to master forex scalping may include studying various scalping strategies, practicing with a demo account, and keeping a close eye on market conditions.

Which Time Frame Is Best for Scalping?

- Scalp trades can be executed in 1 minute, 3 minutes, 5 minutes, or even 15 minutes time frame. However, the choice depends on the trade and the asset involved. The 15 minutes time frame is not so common. Beginners generally trade around the 5 minutes time frame to strike the right advantage. But the advanced traders can go with 3 minutes trade precisely

Which Pair Is Best for Scalping?

- FX Traders should consider scalping major currency pairs such as the EUR/USD, GBP/USD, and AUD/USD, as well as minor currency pairs including the AUD/GBP.

How Many Pips Do You Use for Scalping?

- Scalpers like to try and scalp between 5 and 10 pips from each trade they make and repeat this process over and over throughout the day.

How Do You Become a Successful Scalper?

- Each scalper's success depends on his/her individual trading strategies. Whatever, some tips on becoming a successful scalper include staying disciplined, keeping a close eye on the markets, and always using stop-loss orders to protect your capital.

Which Forex Broker Is Best for Scalping?

- There is no definitive answer to this question as different traders have different preferences. Some forex brokers offer special accounts for scalpers, while others charge higher fees for this type of trading. Ultimately, it is up to the individual trader to decide which broker is best for

Why Do Some Brokers Not Allow Scalping?

- Many brokers do not allow scalping because they view it as a form of gambling. Scalping generally involves taking quick, small profits on a large number of trades, which can add up to a significant amount of money over time. Moreover, many brokers view this as an unfair advantage and do not allow it.

Is Forex Scalping Risky?

- While forex scalping can be profitable, it is considered a risky trading strategy.

How Do Scalpers Buy So Fast?

- The first, and most notorious, is called an AIO bot, or all-in-one bot. These move at an inhuman rate, scanning hundreds of websites every second to check if the PS5 is in stock.

The instant an item drops the bot will buy it and checkout, faster than a human could ever type their details.

What Are Scalping Bots?

- Scalping bots are computer programs that use artificial intelligence to identify and execute trades based on market conditions.

How Many Trades Do Scalpers Do in A Day?

- A scalper may make dozens or even hundreds of trades in a single day.

Conclusion

It is important to be clear-headed and try to keep things simple while implementing various forex scalping strategies. And, an FX trader must master one indicator first before moving on to combinations.

So, check that your strategies are working by either using a demo account to practice or using a significantly small amount to invest. And after that, try to find out your strategies for the foreign exchange.

| # | Forex Broker | Year | Status | For | Against | Type | Regulation | Leverage | Account | Advisors | ||

| 1 |  |

JustMarkets | 2012 | 36% | 4% | ECN/STP | FSA, CySEC, FSCA, FSC | 1:3000* | 1 | Yes | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 |  |

Hantec Markets | 1990 | 35% | 6% | ECN/STP | ASIC, FCA, FSA-Japan, FSC, JSC | 1:2000* | 100 | Yes | ||

| 3 |  |

Valetax | 2023 | 35% | 1% | ECN/STD | FSC | 1:2000* | 10 | Yes | ||

| 4 |  |

KCM Trade | 2016 | 32% | 3% | ECN/STD | FSC | 1:400* | 100 | Yes | ||

| 5 |  |

Plotio | 1983 | 31% | 2% | STP | HKGX, ASIC, SCB | 1:300* | 200 | Yes | ||

| 6 |  |

FISG | 2011 | 30% | 1% | ECN/STD | FSA, CySEC, ASIC | 1:500 | 0.01 | Yes | ||

| 7 |  |

ATFX | 2017 | 25% | 3% | Broker/NDD | FCA, CySEC, FSCA | 1:400* | 100 | Yes | ||

| 8 |  |

Octa | 2011 | 20% | 3% | ECN/STD | Regulation: CySEC, MISA, FSCA and FSC | 1:1000* | 5 | Yes | ||

| 9 |  |

Youhodler | 2018 | 20% | 2% | Exchange | EU (Swiss) licensed | Up to 1:500 | 100 | Yes | ||

| 10 |  |

Uniglobe markets | 2015 | 20% | 3% | ECN/STP | Yes | Up to 1:500 | 100 | Yes | ||

| 11 |  |

IEXS | 2023 | 20% | 6% | ECN/STP | ASIC, FCA | Up to 1:500 | 100 | Yes | ||

| 12 |  |

TradeEU | 2023 | 18% | 4% | CFDs | CySEC | 1:300* | 100 | Yes | ||

| 13 |  |

RoboForex | 2009 | 16% | 4% | ECN/STD | FSC, Number 000138/333 | 1:2000* | 10 | Yes | ||

| 14 |  |

Axiory | 2011 | 15% | 5% | Broker, NDD | IFSC, FSC, FCA (UK) | 1:777* | 10 | Yes | ||

| 15 |  |

FBS | 2009 | 13% | 4% | ECN/STD | IFSC, CySEC, ASIC, FSCA | 1:3000* | 100 | Yes |