Youhodler Review and Information 2026

Regulation

EU (Swiss) licensed

Broker Type

Exchange

Headquartered

Switzerland

Website

Free Support

Yes

Bonuses, Promotions

Meme Tokens Lucky Draw

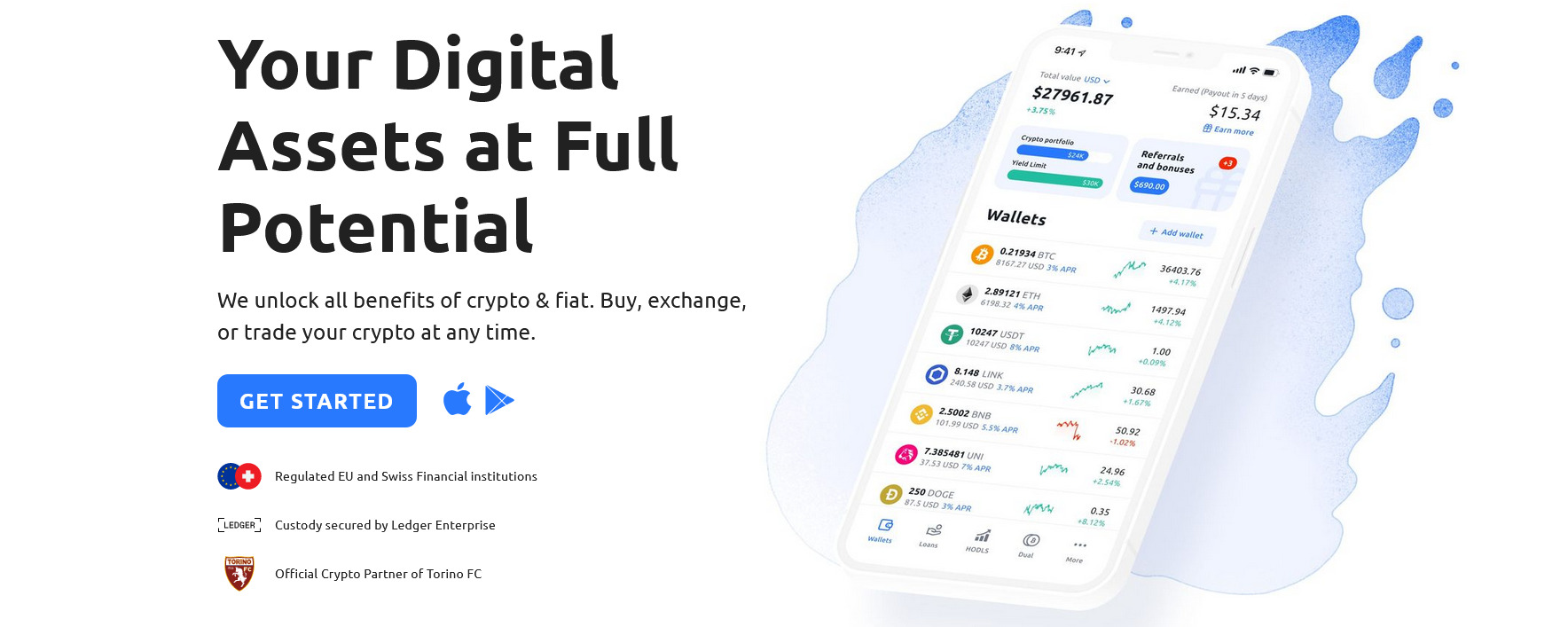

Easy cryptocurrency exchange, collateralize loans, and earn interest on your crypto holdings

As a new option to earn income using cryptocurrencies; both stable and altcoins, we’ll discuss Youhodler here. Consequently, in the following paragraphs, we’ll examine the efficacy and dependability of the latest method for earning interest on Bitcoin and cryptocurrency savings accounts.

Youhodler is a cryptocurrency platform that facilitates easy exchanges, loans with cryptocurrency as collateral, and interest on cryptocurrency holdings. Let’s discuss.

What Is Youhodler

Many people regard cryptocurrencies as a possible alternative to established fiat currencies. However, the asset’s extreme volatility often scares away inexperienced investors.

The key to making money in this market, like in any market, is to keep your assets fixed at a certain price and not give in to market pressures. But it’s far simpler to say than to actually accomplish.

Maintaining and protecting cryptocurrency holdings (HODL in English) is challenging because of the volatile performance of cryptocurrencies, especially when instantaneous access to assets is required.

Youhodler was released as a means of locating novel ways to investigate earnings potential. Youhodler loans can be secured against an investor’s cryptocurrency holdings on the platform, but the investors can keep their cryptocurrency holdings.

The platform was an immediate success among crypto enthusiasts, leading to the development of a wide range of crypto-fiat financial services. To help cryptocurrency investors make informed decisions, we’ve provided a thorough analysis of Youhodler and the value it can provide to the market.

Who, though, oversees the Youhodler website?

Youhodler is a Swiss company that offers cryptocurrency lending services. However, the Youhodler brand is legally owned by Naumard LTD, a Cyprus-based company with an office at Arch Makariou III, 172, Melford Tower, 3027 Limassol, Cyprus.

You can still HODL without waiting for the price to go up, which is one of its key ideas. Instantaneously borrow fiat funds based on the value of Bitcoin holdings. Stablecoins can also be used in conjunction with cryptocurrency exchanges and transactions, as well as the other way around.

Having the funds sent directly into a user’s bank account or charged to a credit card would be the most convenient option. Users can furthermore open a Youhodler savings account to save their cryptocurrency.

Youhodler could be thought of as a virtual savings account for your digital currency. It’s a quick and simple way for users to move money or other valuables, and it’s efficient.

Youhodler Trading Information 2026

| Broker Website | Youhodler |

|---|---|

| Address | Avenue du Théâtre 7, 1005, Lausanne, Switzerland, Lausanne, Switzerland |

| Headquarters | Switzerland |

| 24 hour support | Yes |

| Partnership programs | Yes |

| Expert advisors | Yes |

| Free education | Yes |

| Bonuses, Promotions | Meme Tokens Lucky Draw |

| Sponsorship contests, competitions | Yes |

| Trading by phone | 50% Forex Deposit Bonus |

| Mobile trading | Yes |

| Automated trading | Yes |

| Demo account | Yes |

| Swaps | Yes |

| 24/5 trading | Yes |

| Scalping | Yes |

| Hedging | Yes |

| Digits after the dot in quotes | Yes |

| Minimum position size | 0.01 |

| Pip spread on majors | 0.0 Pips* |

| Spread Type | |

| Maximum Leverage | Up to 1:500 |

| ECN,STP | Yes |

| Standard account, $ | Yes |

How Does Youhodler Work?

The platform is designed to offer its users a comprehensive service. Everything a Youhodler crypto enthusiast or trader could want is right here.

To put it another way, Youhodler provides several options for making the most of your digital holdings. Multi HODL and Exchange are two new offerings from Youhodler.

An explanation of both items is provided below.

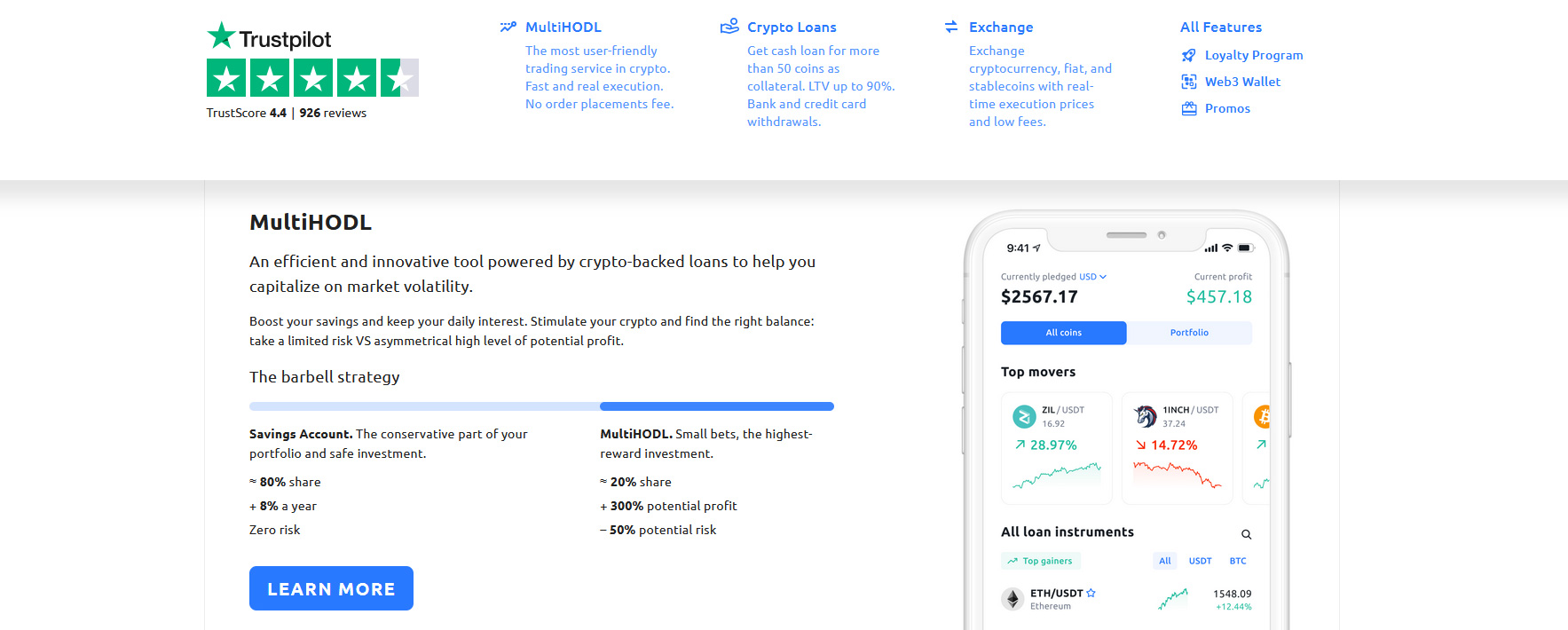

When it comes to capitalizing on market volatility, Multi HODL is a far superior tool to trading on margin at exchanges or CFDs.

All the advantages of cryptocurrency trading platforms and CFD trading are rolled into one with Multi HODL.

Key characteristics of YouHodler’s platform

- Easy-to-use UI that doesn’t require an order book.

- Free of the bidding and asking spread.

- Without cost for a rollover (swap).

- Up to a 30:1 leverage (multiplier) is possible.

- The ability to make quick changes to active agreements.

- Profit from the multiplication of your funds without actually having to purchase cryptocurrency.

- Easy account administration for trading.

Youhodler Exchange offers minimal costs and instant buy/sell pricing for a variety of cryptocurrencies, fiat currencies, and stablecoins.

You can now buy Bitcoin using your credit card (VISA, Mastercard) or SEPA bank account, and you can instantly convert your funds between any two cryptocurrencies, as well as fiat currencies and stablecoins. You can buy Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and a plethora of other coins. US Dollar, Euro, Swiss Franc, and British Pound are all accepted.

Youhodler Services And Products

Each Bitcoin loan needs to account for the market’s volatility in terms of pricing. Cryptocurrency prices, as many investors know, are prone to wild swings, often by double digits.

youhodler products

Youhodler has put in place procedures to ensure that the loan amount will not change even if the price of the cryptocurrency drops. There is a “lower price limit” for each possible loan package.

Youhodler claims that the Price Down Limit (PDL) gives the provider the authority to sell the guarantee and close the loan if the price of the guarantee drops below that level. If your guarantee’s price drops below 2/3 of the PDL, you’ll receive an email alert.

Your current budget won’t increase for this action.

Increases in the value of cryptocurrencies would mean: The “Take Profit” option, on the other hand, can be used if the value of the crypto-collateral rises. You can specify a Take Profit level, and whenever the price reaches that level, Youhodler will sell the collateral to repay the loan and send you the proceeds.

| Mini account, $ | 100 |

|---|---|

| Popular payment methods | Bank wire, Credit card, Cryptocurrencies, Stablecoins |

| Account currencies | (USD, EUR, CHF, GBP) as well as all major crypto currencies and tokens (BTC, ETH, LTC, XLM, XRP, BNB, USDT, USDC, TUSD, PAXG, DAI, etc). |

| Available assets | Yes |

| Languages | English |

| Platforms | WebTrader |

| Broker type | Exchange |

| Regulation | Yes - EU (Swiss) licensed |

| Foundation | 2018 |

| Copy Trading Brokers | Yes |

| Bitcoin Forex Brokers | Yes |

Youhodler Review and Information 2026

Regulation

EU (Swiss) licensed

Broker Type

Exchange

Headquartered

Switzerland

Website

Free Support

Yes

Bonuses, Promotions

Meme Tokens Lucky Draw

Easy cryptocurrency exchange, collateralize loans, and earn interest on your crypto holdings

As a new option to earn income using cryptocurrencies; both stable and altcoins, we’ll discuss Youhodler here. Consequently, in the following paragraphs, we’ll examine the efficacy and dependability of the latest method for earning interest on Bitcoin and cryptocurrency savings accounts.

Youhodler is a cryptocurrency platform that facilitates easy exchanges, loans with cryptocurrency as collateral, and interest on cryptocurrency holdings. Let’s discuss.

What Is Youhodler

Many people regard cryptocurrencies as a possible alternative to established fiat currencies. However, the asset’s extreme volatility often scares away inexperienced investors.

The key to making money in this market, like in any market, is to keep your assets fixed at a certain price and not give in to market pressures. But it’s far simpler to say than to actually accomplish.

Maintaining and protecting cryptocurrency holdings (HODL in English) is challenging because of the volatile performance of cryptocurrencies, especially when instantaneous access to assets is required.

Youhodler was released as a means of locating novel ways to investigate earnings potential. Youhodler loans can be secured against an investor’s cryptocurrency holdings on the platform, but the investors can keep their cryptocurrency holdings.

The platform was an immediate success among crypto enthusiasts, leading to the development of a wide range of crypto-fiat financial services. To help cryptocurrency investors make informed decisions, we’ve provided a thorough analysis of Youhodler and the value it can provide to the market.

Who, though, oversees the Youhodler website?

Youhodler is a Swiss company that offers cryptocurrency lending services. However, the Youhodler brand is legally owned by Naumard LTD, a Cyprus-based company with an office at Arch Makariou III, 172, Melford Tower, 3027 Limassol, Cyprus.

You can still HODL without waiting for the price to go up, which is one of its key ideas. Instantaneously borrow fiat funds based on the value of Bitcoin holdings. Stablecoins can also be used in conjunction with cryptocurrency exchanges and transactions, as well as the other way around.

Having the funds sent directly into a user’s bank account or charged to a credit card would be the most convenient option. Users can furthermore open a Youhodler savings account to save their cryptocurrency.

Youhodler could be thought of as a virtual savings account for your digital currency. It’s a quick and simple way for users to move money or other valuables, and it’s efficient.

Youhodler Trading Information 2026

| Broker Website | Youhodler |

|---|---|

| Address | Avenue du Théâtre 7, 1005, Lausanne, Switzerland, Lausanne, Switzerland |

| Headquarters | Switzerland |

| 24 hour support | Yes |

| Partnership programs | Yes |

| Expert advisors | Yes |

| Free education | Yes |

| Bonuses, Promotions | Meme Tokens Lucky Draw |

| Sponsorship contests, competitions | Yes |

| Trading by phone | 50% Forex Deposit Bonus |

| Mobile trading | Yes |

| Automated trading | Yes |

| Demo account | Yes |

| Swaps | Yes |

| 24/5 trading | Yes |

| Scalping | Yes |

| Hedging | Yes |

| Digits after the dot in quotes | Yes |

| Minimum position size | 0.01 |

| Pip spread on majors | 0.0 Pips* |

| Spread Type | |

| Maximum Leverage | Up to 1:500 |

| ECN,STP | Yes |

| Standard account, $ | Yes |

How Does Youhodler Work?

The platform is designed to offer its users a comprehensive service. Everything a Youhodler crypto enthusiast or trader could want is right here.

To put it another way, Youhodler provides several options for making the most of your digital holdings. Multi HODL and Exchange are two new offerings from Youhodler.

An explanation of both items is provided below.

When it comes to capitalizing on market volatility, Multi HODL is a far superior tool to trading on margin at exchanges or CFDs.

All the advantages of cryptocurrency trading platforms and CFD trading are rolled into one with Multi HODL.

Key characteristics of YouHodler’s platform

- Easy-to-use UI that doesn’t require an order book.

- Free of the bidding and asking spread.

- Without cost for a rollover (swap).

- Up to a 30:1 leverage (multiplier) is possible.

- The ability to make quick changes to active agreements.

- Profit from the multiplication of your funds without actually having to purchase cryptocurrency.

- Easy account administration for trading.

Youhodler Exchange offers minimal costs and instant buy/sell pricing for a variety of cryptocurrencies, fiat currencies, and stablecoins.

You can now buy Bitcoin using your credit card (VISA, Mastercard) or SEPA bank account, and you can instantly convert your funds between any two cryptocurrencies, as well as fiat currencies and stablecoins. You can buy Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and a plethora of other coins. US Dollar, Euro, Swiss Franc, and British Pound are all accepted.

Youhodler Services And Products

Each Bitcoin loan needs to account for the market’s volatility in terms of pricing. Cryptocurrency prices, as many investors know, are prone to wild swings, often by double digits.

youhodler products

Youhodler has put in place procedures to ensure that the loan amount will not change even if the price of the cryptocurrency drops. There is a “lower price limit” for each possible loan package.

Youhodler claims that the Price Down Limit (PDL) gives the provider the authority to sell the guarantee and close the loan if the price of the guarantee drops below that level. If your guarantee’s price drops below 2/3 of the PDL, you’ll receive an email alert.

Your current budget won’t increase for this action.

Increases in the value of cryptocurrencies would mean: The “Take Profit” option, on the other hand, can be used if the value of the crypto-collateral rises. You can specify a Take Profit level, and whenever the price reaches that level, Youhodler will sell the collateral to repay the loan and send you the proceeds.

| Mini account, $ | 100 |

|---|---|

| Popular payment methods | Bank wire, Credit card, Cryptocurrencies, Stablecoins |

| Account currencies | (USD, EUR, CHF, GBP) as well as all major crypto currencies and tokens (BTC, ETH, LTC, XLM, XRP, BNB, USDT, USDC, TUSD, PAXG, DAI, etc). |

| Available assets | Yes |

| Languages | English |

| Platforms | WebTrader |

| Broker type | Exchange |

| Regulation | Yes - EU (Swiss) licensed |

| Foundation | 2018 |

| Copy Trading Brokers | Yes |

| Bitcoin Forex Brokers | Yes |