Latest Article: What is Grid Trading?

Latest Article: What is Grid Trading?

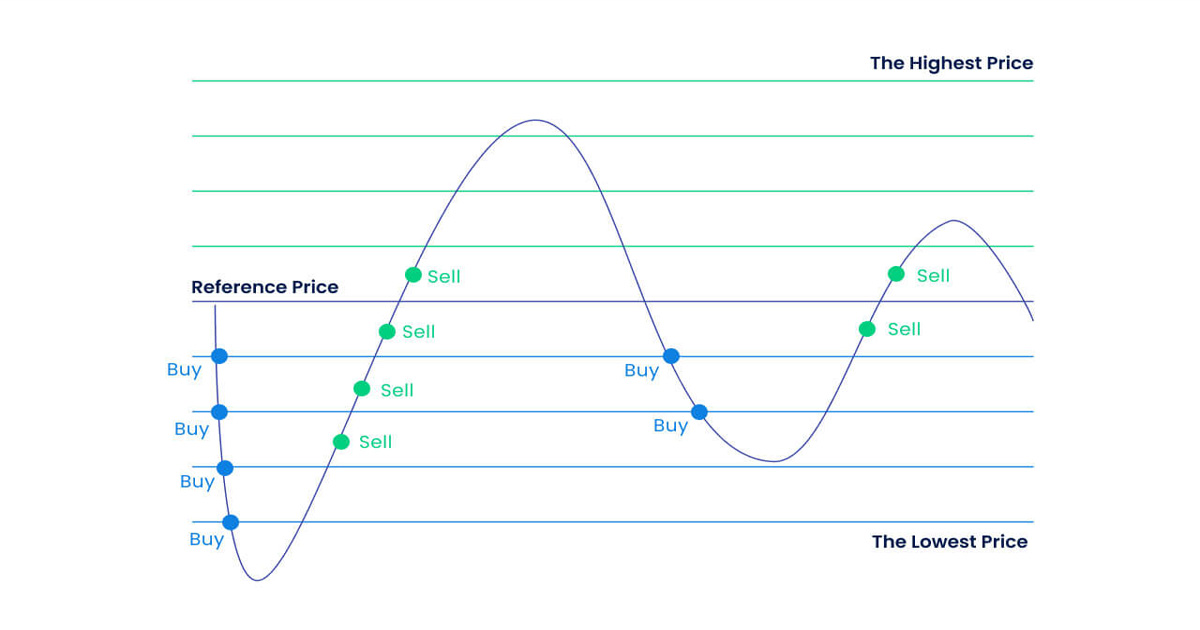

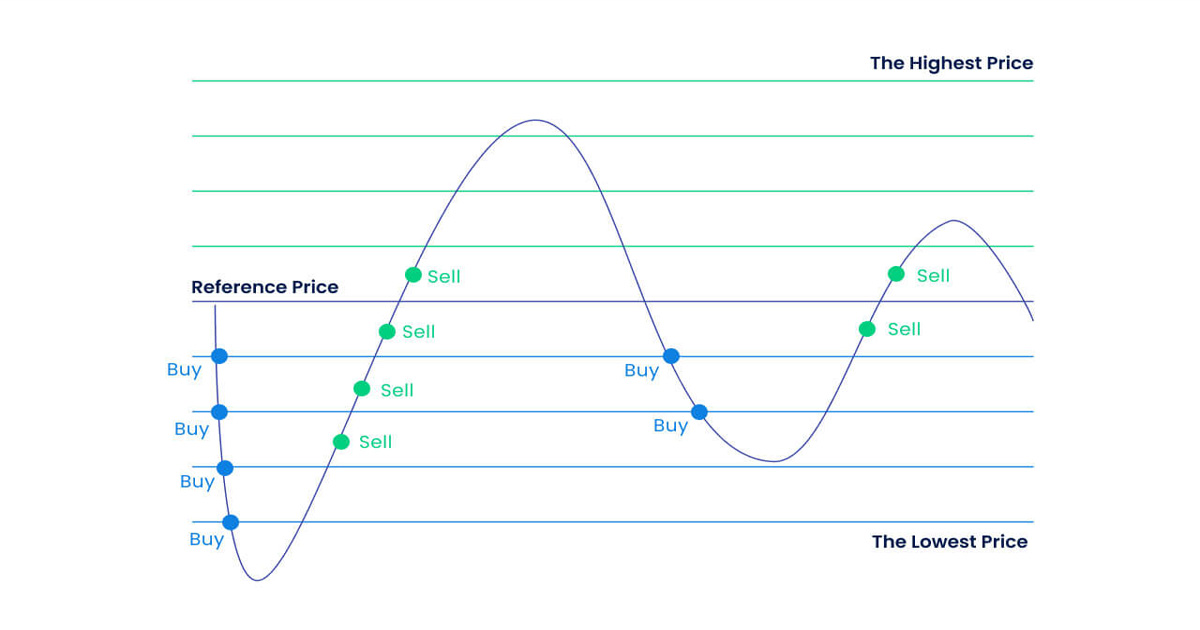

With grid trading, you can profit by placing long orders below the current trading price and short orders above the current trading price. You essentially place multiple orders at specific price intervals and create a grid

-

- by ALLFOREXRATING.COM

- 2nd December 2022 | Post Views: 1594

Grid trading is a forex technique that helps set several pre-decided buying and selling price levels to execute automatic orders. It is a helpful way to trade as it keeps human emotions aside and only functions based on market momentum.

In our article, we will learn about grid trading and its strategies in depth.

What is grid trading?

With grid trading, you can profit by placing long orders below the current trading price and short orders above the current trading price. You essentially place multiple orders at specific price intervals and create a grid. When the market increases, decreases, or moves sideways to touch these prices, the order is automatically executed. Since orders are placed in both market directions, it is also called a double grid strategy.

Grid trading allows you to trade in both ranging and trending markets. When the market is moving in a strong trend direction, more orders placed in that direction are executed and reap profits. On the other hand, when the market is trading sideways or between a range, pending orders are executed, and a trader is able to profit from the market range. If the trader sees the market moving against the direction in which the trade has been executed, they can exit from the order immediately to limit losses.

There are two main types of forex grids:

- The pure trading grid is where you can both sell and buy orders irrespective of the market’s direction. Such a grid is not influenced by the market trending or ranging, and orders are executed regardless of the same as soon as the currency pair prices touch the set prices.

- The modified trading grid also helps set both buy and sell orders, but it is influenced by the market’s current trending direction. This type of trading grid works best to capitalise on the trending markets and execute orders only when there is a strong uptrend or downtrend.

Benefits of grid trading

- Since grid trading is automatic, it is not influenced by human emotions and ensures that all profits are taken on the basis of market momentum.

- Using a grid trading bot allows you to automate multiple trading orders. The bot also monitors the trading chart and lets you focus on other tasks instead.

- A grid trading robot is made by defining several rules, and to ensure that these rules are taken into consideration, strategies need to be back-tested to see which one is perfect for the trader to enter or exit the trade. This leads to back testing of all strategies with predefined rules which help in identifying ideal price levels.

- This strategy works in all time frames, and traders can change their trading time frame multiple times without affecting the grid’s results.

- In this strategy, traders do not have to predict the market movement or direction as it sets and executed trades in all directions for maximum benefit.

Types of grid trading strategy

Gann Grid Trading Strategy

Gann lines are a sequence of angled lines wherein the trader selects the starting price level for the line to extend in the future. It draws angles at the 45, 82.5, 75, 71.25, 63.75, 26.25-, 18.75-, 15- and 7.5-degree angles. It is used to predict support and resistance levels in the market. When used with the grid trading strategy, it provides traders with confirmed long and short price levels to be set above and below the price levels.

With the intersection of Gann lines and the forex grid, traders can identify potential uptrends and downtrends. When you have placed a short and long order with the help of the grid trading strategy, and the current currency pair price is trading below the Gann lines, it indicates a bullish market and confirms a long trend.

On the other hand, when you have placed a short order with the grid strategy and the current currency pair prices are trending above the Gann lines, it indicates a bearish market and confirms the short entry point.

ATR Grid Trading Strategy

The Average True Range (ATR) is a tool that indicates market volatility and confirms buying price signals based on how near or far the current currency pair price is to the average true range price level. Traders can use the ATR value to measure the currency pair’s price volatility in the market and then set a grid system accordingly. This means traders can use the ATR by adding and subtracting the ATR value from the specific price level at which the trader wants to set their long and short orders.

Forex Double Grid Strategy

The forex double grid strategy is a neutral strategy that does not require the traders to predict the market direction to set orders. It helps in placing stop loss and take profit orders which are automatically executed if the market moves upward or downward. It opens several positions opposite to one another to ensure that at least one of the two groups is always profitable.

You can either manage the two grids separately with their own stop losses and take profits or manage them together but manage each trading pair separately. Hence, it helps reap profits irrespective of the direction in which the market moves. With this strategy, a trader is able to:

- Execute buy limit orders when the market drops below the current level

- Execute sell limit orders when the market rises above the current level

- Execute stop orders to buy and sell currency pairs in the direction of the current trend right when the price crosses the predetermined level

Write a Comment

Latest Article: What is Grid Trading?

With grid trading, you can profit by placing long orders below the current trading price and short orders above the current trading price. You essentially place multiple orders at specific price intervals and create a grid

Grid trading is a forex technique that helps set several pre-decided buying and selling price levels to execute automatic orders. It is a helpful way to trade as it keeps human emotions aside and only functions based on market momentum.

In our article, we will learn about grid trading and its strategies in depth.

What is grid trading?

With grid trading, you can profit by placing long orders below the current trading price and short orders above the current trading price. You essentially place multiple orders at specific price intervals and create a grid. When the market increases, decreases, or moves sideways to touch these prices, the order is automatically executed. Since orders are placed in both market directions, it is also called a double grid strategy.

Grid trading allows you to trade in both ranging and trending markets. When the market is moving in a strong trend direction, more orders placed in that direction are executed and reap profits. On the other hand, when the market is trading sideways or between a range, pending orders are executed, and a trader is able to profit from the market range. If the trader sees the market moving against the direction in which the trade has been executed, they can exit from the order immediately to limit losses.

There are two main types of forex grids:

- The pure trading grid is where you can both sell and buy orders irrespective of the market’s direction. Such a grid is not influenced by the market trending or ranging, and orders are executed regardless of the same as soon as the currency pair prices touch the set prices.

- The modified trading grid also helps set both buy and sell orders, but it is influenced by the market’s current trending direction. This type of trading grid works best to capitalise on the trending markets and execute orders only when there is a strong uptrend or downtrend.

Benefits of grid trading

- Since grid trading is automatic, it is not influenced by human emotions and ensures that all profits are taken on the basis of market momentum.

- Using a grid trading bot allows you to automate multiple trading orders. The bot also monitors the trading chart and lets you focus on other tasks instead.

- A grid trading robot is made by defining several rules, and to ensure that these rules are taken into consideration, strategies need to be back-tested to see which one is perfect for the trader to enter or exit the trade. This leads to back testing of all strategies with predefined rules which help in identifying ideal price levels.

- This strategy works in all time frames, and traders can change their trading time frame multiple times without affecting the grid’s results.

- In this strategy, traders do not have to predict the market movement or direction as it sets and executed trades in all directions for maximum benefit.

Types of grid trading strategy

Gann Grid Trading Strategy

Gann lines are a sequence of angled lines wherein the trader selects the starting price level for the line to extend in the future. It draws angles at the 45, 82.5, 75, 71.25, 63.75, 26.25-, 18.75-, 15- and 7.5-degree angles. It is used to predict support and resistance levels in the market. When used with the grid trading strategy, it provides traders with confirmed long and short price levels to be set above and below the price levels.

With the intersection of Gann lines and the forex grid, traders can identify potential uptrends and downtrends. When you have placed a short and long order with the help of the grid trading strategy, and the current currency pair price is trading below the Gann lines, it indicates a bullish market and confirms a long trend.

On the other hand, when you have placed a short order with the grid strategy and the current currency pair prices are trending above the Gann lines, it indicates a bearish market and confirms the short entry point.

ATR Grid Trading Strategy

The Average True Range (ATR) is a tool that indicates market volatility and confirms buying price signals based on how near or far the current currency pair price is to the average true range price level. Traders can use the ATR value to measure the currency pair’s price volatility in the market and then set a grid system accordingly. This means traders can use the ATR by adding and subtracting the ATR value from the specific price level at which the trader wants to set their long and short orders.

Forex Double Grid Strategy

The forex double grid strategy is a neutral strategy that does not require the traders to predict the market direction to set orders. It helps in placing stop loss and take profit orders which are automatically executed if the market moves upward or downward. It opens several positions opposite to one another to ensure that at least one of the two groups is always profitable.

You can either manage the two grids separately with their own stop losses and take profits or manage them together but manage each trading pair separately. Hence, it helps reap profits irrespective of the direction in which the market moves. With this strategy, a trader is able to:

- Execute buy limit orders when the market drops below the current level

- Execute sell limit orders when the market rises above the current level

- Execute stop orders to buy and sell currency pairs in the direction of the current trend right when the price crosses the predetermined level

| # | Forex Broker | Year | Status | For | Against | Type | Regulation | Leverage | Account | Advisors | ||

| 1 |  |

JustMarkets | 2012 | 36% | 4% | ECN/STP | FSA, CySEC, FSCA, FSC | 1:3000* | 1 | Yes | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 |  |

Hantec Markets | 1990 | 35% | 6% | ECN/STP | ASIC, FCA, FSA-Japan, FSC, JSC | 1:2000* | 100 | Yes | ||

| 3 |  |

Valetax | 2023 | 35% | 1% | ECN/STD | FSC | 1:2000* | 10 | Yes | ||

| 4 |  |

KCM Trade | 2016 | 32% | 3% | ECN/STD | FSC | 1:400* | 100 | Yes | ||

| 5 |  |

Plotio | 1983 | 31% | 2% | STP | HKGX, ASIC, SCB | 1:300* | 200 | Yes | ||

| 6 |  |

FISG | 2011 | 30% | 1% | ECN/STD | FSA, CySEC, ASIC | 1:500 | 0.01 | Yes | ||

| 7 |  |

ATFX | 2017 | 25% | 3% | Broker/NDD | FCA, CySEC, FSCA | 1:400* | 100 | Yes | ||

| 8 |  |

Octa | 2011 | 20% | 3% | ECN/STD | Regulation: CySEC, MISA, FSCA and FSC | 1:1000* | 5 | Yes | ||

| 9 |  |

Youhodler | 2018 | 20% | 2% | Exchange | EU (Swiss) licensed | Up to 1:500 | 100 | Yes | ||

| 10 |  |

Uniglobe markets | 2015 | 20% | 3% | ECN/STP | Yes | Up to 1:500 | 100 | Yes | ||

| 11 |  |

IEXS | 2023 | 20% | 6% | ECN/STP | ASIC, FCA | Up to 1:500 | 100 | Yes | ||

| 12 |  |

TradeEU | 2023 | 18% | 4% | CFDs | CySEC | 1:300* | 100 | Yes | ||

| 13 |  |

RoboForex | 2009 | 16% | 4% | ECN/STD | FSC, Number 000138/333 | 1:2000* | 10 | Yes | ||

| 14 |  |

Axiory | 2011 | 15% | 5% | Broker, NDD | IFSC, FSC, FCA (UK) | 1:777* | 10 | Yes | ||

| 15 |  |

FBS | 2009 | 13% | 4% | ECN/STD | IFSC, CySEC, ASIC, FSCA | 1:3000* | 100 | Yes |